No! I don't want to talk about what you always need urgent 2k for... I want to talk about Credit as a source of (business) financing and in some societies, qualification for any form of financing.

Specifically, I'll like to talk about WHAT we do all the time which affects our ability to receive credit - call it our CREDITWORTHINESS (or as those societies call them - credit score)

sidenote

A credit score is a numerical expression based on a level analysis of a person's credit files, to represent the creditworthiness of an individual. A credit score is primarily based on a credit report, information typically sourced from credit bureaus

Anyways... a while back, a friend of mine asked me about possible ways through which she could raise financing for her Business idea and so I decided to write (on my Whatsapp Channel) about Business Financing. I hope to someday develop that and share it here as well.

In Summary, I explored 3 ways to raise finance...

- Investment (for shares/stock/equity)

- Lending (loans, Debentures)

- Grants/Donations

I also mentioned that there are a ton of reasons why so many savvy businesses prefer Loan Financing over Equity Financing...

coz you know..? "Other People's Money"

to attempt a brief illustration...

Imagine you have 1 Million in your savings account... you take it out invest it in a business and at the end of a good business year, it gives you profits of 100 thousand... cool right?

On the other hand... imagine you had said 1 mil... and instead of taking it out and investing... u borrowed another 1mil from the bank and invested it instead...

at the end of the year... you would have made that same 100k... paid off your interest on that loan of approximately 10% and also made an additional approximately 5% on interests on savings on that 1mil in the bank that u didn't touch.

Basically, you used "Other People's Money" to make money for yourself while your own money just sat there in the bank yielding interest on savings for you.

and here's the beauty...

even if it was a bad business year and you didn't make the 100k profit but lost instead... with loan financing,

- you still have your savings in the bank to fall back to for salvation (if need be)...

- you'll still earn that little interest on savings...

- ...and People like "Orange Man" made their wealth and fame from Bankruptcy hail-Marys like these (story for another day over beer)

...and that doesn't even scratch the surface of the advantages of loan financing

Now Anyone who's done any form of small business in Cameroon - my lovely country (rolls eyes) - will tell you that

- Raising startup capital around here is hell

- Banks DO NOT lend to small businesses

- Friends and Family NEVER have money to invest

Let me try to limit the babble about business... My intention for this write is to focus more on our ability as individuals to raise money from the people around us whenever we find ourselves in a bind and need so desperately to be saved.

What I'm interested in is to attempt to show you the reason why friends and family usually NEVER have money to lend you when you find yourself in a bind, for your personal undertakings and even for your business initiatives... but money shows up when it's time to buy Concours or to fall bush.

this can be summarized into...

is my money really going to come back if I give him/her?

Any person's willingness to lend you money is most often greatly informed by their belief/trust that you'll pay back - your creditworthiness

If I believe that the 100k I'm giving you today will be returned in precisely 1 week as you promised... I won't hesitate to give you. This is how almost everyone thinks... and that belief/trust is informed by their previous dealings with you ...need I say more?

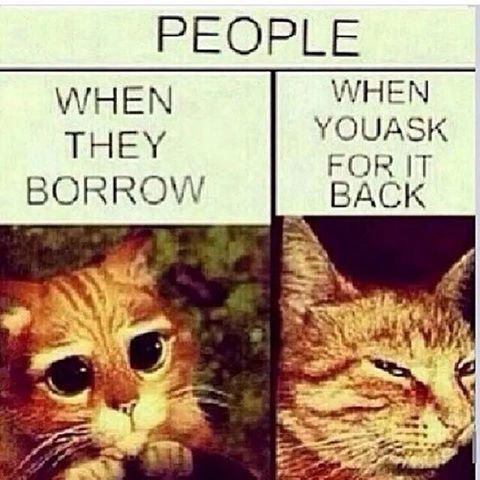

Have you borrowed an urgent 10k in the past and not paid it back?

...in time?

...without any reasons or request for an extension?

Each transaction/interaction you have with people or institutions is what builds your (informal) credit score.... and your credit score is what determines IF and HOW MUCH the people around you can lend to you when you need it.

Now if you're thinking... I'm a strong, independent (wo)man who doesn't like to borrow from people... (how cute) Good for you

...for everyone else...

start building (or repairing) your credit score so that you can take advantage of it for seizing future opportunities or solving future challenges

...and the way you'll do this is by scoring great points every time you transact with someone - whether financially or not. Basically, be true to the words that come out of your mouth.